oregon tax payment due date

Taxable base tax rate. 4th 10-1 to 12-31 January 20.

Alabama Eviction Notice Free Printable Documents 30 Day Eviction Notice Eviction Notice Real Estate Forms

Quarter Period Covered Due Date.

. Please remember Oregon city income tax returns are due April 15th or if it falls on a weekend the first business day after April 15th. Annual Use Fuel User - Annual tax less than 10000 as authorized by the department. Due Dates for 2021 - 2022 Tax Payments.

Baker County TreasurerTax Collector 1995 Third Street 140 Baker City OR 97814 Phone. Mail the payment and voucher to. Your browser appears to have cookies disabled.

The Department of Revenue DOR has issued a Directors Order providing relief similar to that provided by the IRS by postponing the Oregon filing and payment due date for individuals for tax year 2020. Postmarks accepted on mailed payments. Important Dates Installment Options Postmarks.

Oregon property taxes are assessed for the July 1st to June 30th fiscal year. Tax statements are sent to owners by October 25th each year. Electronic payment using Revenue Online.

Corporations whose Oregon return would otherwise be due on May 15th will also. The interest rate currently used is 6. However Senate Bill SB 1524 signed into law at the end of March 2022 now requires pass-through entities to pay estimated taxes for the Oregon PTE-E beginning June 15 2022.

The statements are mailed between October 15 and October 25 to each property owner in the county. Payment Due Dates 1 Oregon withholding tax payment due dates are determined by corresponding federal due dates as outlined in the following rules. Please see Form OR-65 Instructions for due dates for non-calendar-year filers.

4 Payments are due on the last day of the 4th 7th and 10th months of the tax year and the first month immediately following the end of the tax year. Your payroll tax payments are due on the last day of the month following the end of the quarter. 2nd 4-1 to 6-30 July 20.

First installment of property taxes due. Service provider fees may apply. 5 Due dates of payments for short-period returns.

To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self. April 15 July 31 October 31 January 31. Oregon doesnt tax your military pay if you arent an Oregon resident.

If you performed active military service in 2021 and your Defense Finance and. The final 13 payment is due by May 15th. The due dates for estimated payments are.

Please refer to the chart below or the backside of your tax statement to keep aware of the dates. Mail a check or money order. Online or telephone 1-888-643-8041 payments available until midnight.

Annual Use Fuel User - Vehicle Weight. Ad Owe back tax 10K-200K. Oregon will require 2020 first quarter estimated tax payments to be made on April 15 2020.

Tax Office Tax Payments. Corporate Income and Excise. Returns filed late will incur a 2500 late filing fee as well as monthly penalty 1 ½ and interest 12 charges.

24 new employer rate Special payroll tax offset. Here is a list of frequently asked questions which will be updated as more information. Annual Use Fuel User - Annual tax less than 10000 as authorized by the department.

Electronic payment from your checking or savings account through the Oregon Tax Payment System. Quarter Period Covered Due Date. Get Your Past-Due Taxes Done Today.

Rule 1 - If the federal tax due is less than 1000 at the end of any calendar quarter the Oregon tax due must be paid by the end of the month following the end of the. File your 2021 taxes even if you missed the deadline. Enter the month day and year for the beginning and end date of the tax year for this payment.

Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950 Form OR-19-V instructions Tax year. Ad The US Tax Filing Deadline was April 18 2022. See if you Qualify for IRS Fresh Start Request Online.

Owe IRS 10K-110K Back Taxes Check Eligibility. Local banks are no longer accepting property tax payments. 1st 1-1 to 3-31 April 20.

009 00009 for 1st quarter. Get Access to the Largest Online Library of Legal Forms for Any State. Choose to pay directly from your bank account or by credit card.

For tax year 2022 enter. If you do not receive your statement by November 1 call the Tax Department at 503 588-5215. 1st 1-1 to 3-31 April 20.

For most fil-ers this will be January 1 through December 31 of the tax year. November 15th Monday 2021 February 15th Tuesday 2022 May 16th Monday 2022. Annual Use Fuel User - Vehicle Weight.

Cookies are required to use this site. Current Tax Rate Filing Due Dates. 2nd 4-1 to 6-30 July 20.

3 Estimated tax payments are required regardless of when a taxpayer exceeds 1 million of taxable commercial activity. 4th 10-1 to 12-31 January 20. 3rd 7-1 to 9-30 October 20.

An entity must first register with Oregon Revenue Online to make payments which will open on June 6 2022 and make its election annually by the returns due date. Get your tax refund fast. Payments that are received after following years first quarter estimated tax due date April 15 2020 will be applied to estimated tax as of the date the payment is received.

For more information please visit our. Reports must be received by the department on or before January 20 for each year. Failure to pay estimated taxes when due may result in interest being charged from the due date of the payment until the date paid.

Annual domestic employers payments are due on January 31st of each year. Last date to file individual refund claims for tax year 2018. Reports must be received by the department on or before January 20 for each year.

To federal estimated tax payments due on April 15 2021. Oregon offering tax relief due to pandemic wil dfires Federal relief The American Rescue Plan Act of 2021 ARPA is a 19 trillion federal COVID-19 relief bill including more direct payments to taxpayers an expansion of jobless benefits funding for state and local governments and an expansion of vaccinations and virus-testing programs. Marion County mails approximately 124000 property tax statements each year.

3rd 7-1 to 9-30 October 20. Ad The Leading Online Publisher of Oregon-specific Legal Documents. The first payment is due by November 15th.

Payments accepted at the Treasurers Office 850 Main Street Dallas OR between 800 am. The 2019 Oregon corporation incomeexcise tax overpayment will be applied of the date the payment was received by the department. Section 150-316-0332 - Withholding.

14k Yellow Gold Oval Faceted 6 83ct Tanzanite Round Brilliant Diamond Ring

Oregon Form 2290 Heavy Highway Vehicle Use Tax Return

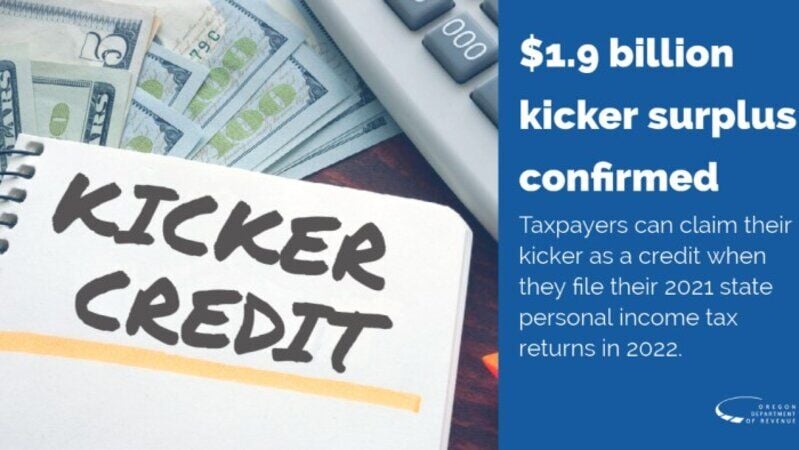

Oregon Man Donated 75 On Tax Return But State Took Entire 1 185 Kicker Rebate Kgw Com

Blog Oregon Restaurant Lodging Association

Printable Sample Late Rent Notice Form Real Estate Forms Room Rental Agreement Sample Business Plan

Prepare Your Oregon State And Irs Income Taxes Now On Efile Com

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Download Ms Excel Customer Services Invoice Templates

Portland 90 Day Notice Of Rent Increase Ez Landlord Forms Being A Landlord Rental Agreement Templates Rental Property Management

Key 2021 Dates For The Oregon Corporate Activity Tax Jones Roth Cpas Business Advisors

Understanding Your Property Tax Bill Clackamas County

State Of Oregon Oregon Department Of Revenue Payments

Record Accurate And Error Free Ifta Fuel Tax Return With The Help Of Global Multi Services

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com